2019 is here and now is the perfect time to reposition your mindset when it relates to wealth. You know what they say…” out with the old and in with the new!” Your master plan should be set and in motion, don’t wait another year. Especially when it relates to your money. If you’re planning on shifting your monetary goals and creating a legacy for your loved ones, you need to leave these three wealth wreckers behind in 2018.

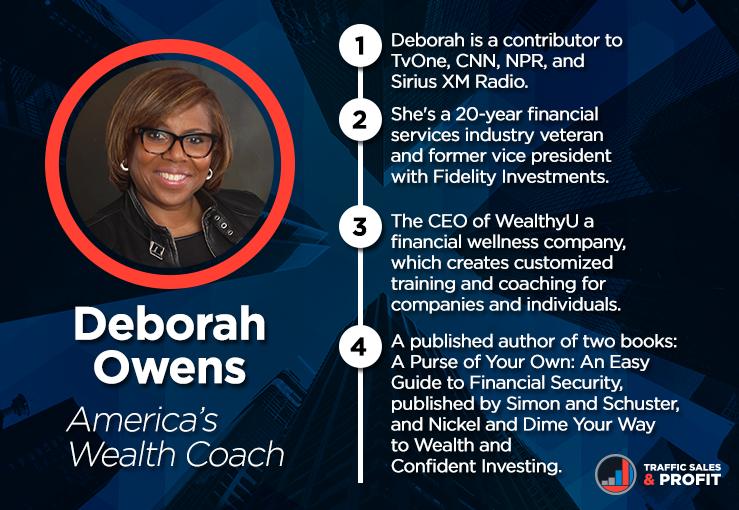

After a recent interview with “Americas Wealth Coach,” Deborah Ownes, she broke down what you need to do to break bad money habits by creating new strategies.

In This Article:

Here’s What You Should Know About Today’s Expert:

Deborah Owens is a 20-year financial expert, author, media personality and nationally recognized public speaker. She has two published books: A Purse of Your Own: An Easy Guide to Financial Security, published by Simon and Schuster, and Nickel and Dime Your Way to Wealth and Confident Investing.

Financial Ignorance

When you lack the proper knowledge about money, you are subject to missing out on many opportunities to build wealth. There should be a fundamental understanding of how the financial markets work and how to execute strategies that are beneficial to your future. African Americans only have 1/10th of the wealth that the majority of the national population has. A large factor is due to the lack of knowledge about investment.

Fear is a major hindrance for the ability to build wealth and lack of knowledge is in direct correlation to the amount of fear. The more knowledge you have, the more confident you become in taking a chance with investing.

Avoiding Risk in “Safe Investments”

Growing up, most of us were taught to save money, but we didn’t have the same conversation concerning investing. Saving is thought to be the more trusted route because it gives people a peace of mind. However, when it comes to investing, make sure you do your research. Position your money so when there is a recession you won’t have to worry. Consider partnering with other people by putting your assets together and leveraging more revenue.

Being an Active Investor

What if we put money into things that benefited us in the long run versus a temporary pleasure? We invest in other businesses daily. Have you considered rerouting those funds to invest in your future?

As entrepreneurs, many of us are in the habit of taking revenue earned and reinvesting it into our business. At some point, you have to capture some of those dollars for yourself, right? Don’t wait to start a tax-deferred retirement savings program for your business. It would be a great benefit to set up a SEP-IRA. Develop a habit of receiving pay on return from your business.

Don’t procrastinate. For every ten years that you wait to invest for retirement, or for that long-term financial independence goal, you’re losing around $100 a day. Don’t be a passive investor, learn how this game works.

Take Deborah’s Wealth Quiz to determine if you are a Wealth Wrecker!

For more about Deborah Owens visit: https://deborahowens.com/

Also make sure you join our FREE Facebook group called Traffic, Sales & Profit with Lamar Tyler

![]() See you soon!

See you soon!

0 Comments